For electronic transactions in the European Single Market, the eIDAS regulation defines three levels of e-signature.

This term (not officially used by eIDAS) refers to any type of electronic signature that doesn’t meet the criteria of advanced or qualified electronic signatures (see below).

A simple electronic signature is the most common type of e-signature because it’s easy to use. For example, simply writing your name under an email might constitute an e-signature. A simple electronic signature can be strengthened and acquire greater legal value if the signer has to use an extra authentication step, such as a code received by SMS.

This is a legally binding electronic signature that uniquely identifies the signatory and offers strong security.

In particular, an AES identifies whether the data has been tampered with after signing, which would invalidate the signature. This feature is essential to making the signature legally binding. Public-key infrastructure (PKI) is the most commonly used technology to provide this security feature.

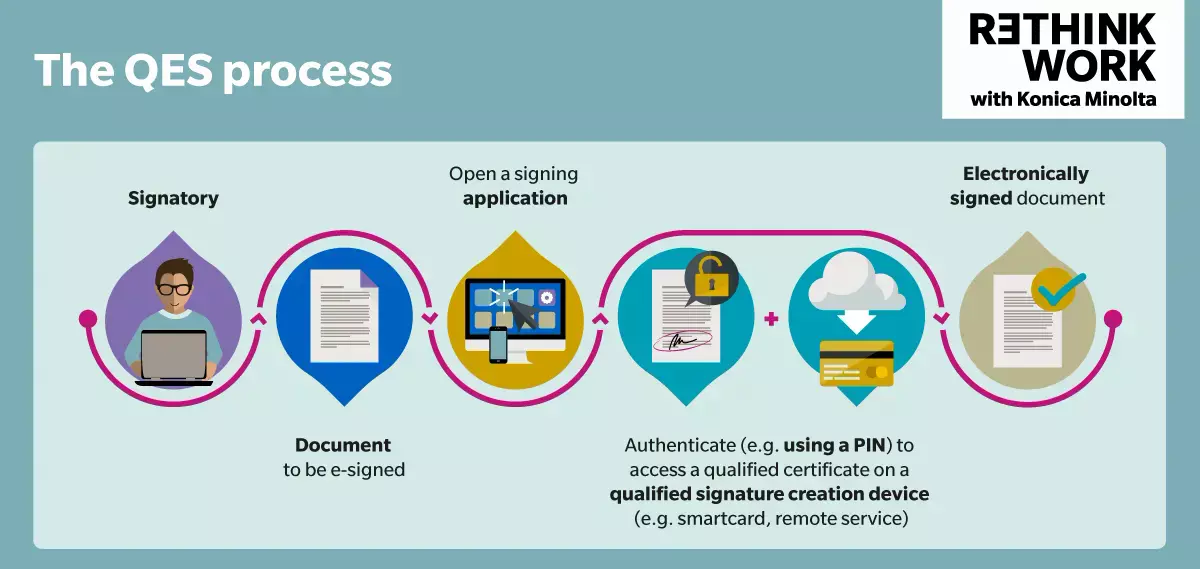

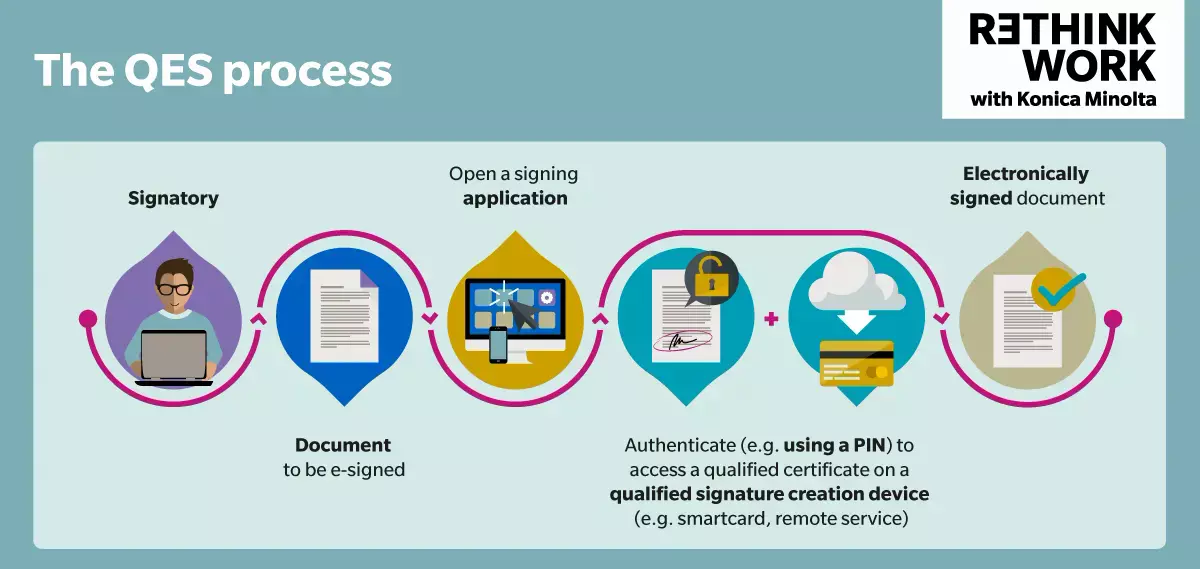

This is stronger than an advanced electronic signature because it is additionally:

- Created by a qualified signature creation device that’s in the possession of the signatory (typically a SIM card, smartcard or USB stick) or is managed by an authorised cloud provider

- Based on a qualified certificate for electronic signatures issued by a qualified trust service provider

Source: https://ec.europa.eu/cefdigital/wiki/display/CEFDIGITAL/What+is+eSignature

Electronic signatures can be used in a wide range of situations, and different types will be more or less appropriate in each.

Simple electronic signatures will generally be appropriate for signing documents such as:

- Some

- Commercial agreements between corporate entities, including NDAs, purchase orders, order acknowledgements, invoices and installation reports

- Consumer agreements, including retail account opening documents, sales terms, terms of service, order confirmations and invoices

Advanced electronic signatures will be more suitable when it comes to large financial transactions, or for signing documents that may present significant legal stakes.

As their legal effects are equivalent to those of handwritten signatures, qualified electronic signatures can be used in many situations (including cross-border) where handwritten signatures would otherwise be used, such as employment, insurance and other contracts; financial transactions such as e-commerce and online banking; and administrative procedures like tax declarations, health insurance authority interactions, and birth certificate requests.

If your organisation is looking to switch to e-signatures, you’ll need to select the electronic signature type that meets your needs, balances security with the user experience, and ensures the e-signature is legally valid. You’ll need to take account of the legal and regulatory context in which you operate — bearing in mind that some use cases may not be compatible with any form of e-signature. In addition, you’ll want to perform a risk and opportunity analysis. That may lead you to choose different e-signature approaches according to the purpose, value and risk level of different transaction types.

As well as making it easier for remote, dispersed and location-independent signatories to sign documents, adopting an e-signature software solution offers a range of other benefits.

According to DocuSign research, increased security is cited as the top business benefit. Then there are the cost and time savings on offer when you compare the speed and simplicity of e-signatures with the printing and logistics associated with acquiring multiple signatures on a contract or other document. Making signature-gathering more efficient can in turn enable faster fulfilment of contractual relationships, and so help you provide better service to customers, partners and suppliers.

When electronically signed documents are also stored and archived electronically, there are opportunities to free up office space and save costs compared with storing physical documents. It’s also easier for authorised users — no matter where they are — to retrieve documents from searchable electronic archives.

Once you decide to move forward with e-signatures, you’ll need to select and roll out a suitable software solution that can be used on different devices. Depending on your processes and the volume of contracts your business needs to create and sign, it could be an opportunity to look at a digital contract management solution that incorporates e-signature workflows.

A digital contract management solution can help you reduce contract creation errors as well as admin and legal costs. It provides you with a better overview of all your contracts, helping you keep track of critical deadlines and contract periods, avoid unwanted contract extensions, and improve supplier performance and negotiation. The solution can also help you further enhance information security by eliminating the risk of paper contracts getting lost or mislaid, and giving you closer control over who can see and work with contracts.

With a digital contract management solution, the role of contract management can be transformed from an administrative necessity to an enabler of better business performance.

If you’re ready to get started with e-signatures, the first step is to define your requirements and understand what type of e-signature solution you need to meet legal, regulatory and operational requirements. As part of your decision-making process, consider whether a digital contract management solution could help make electronic signing even more efficient and deliver additional business benefits.

Make sure you work with a provider that offers expertise and a range of solutions to choose from, and is able to integrate your chosen solution into your existing productivity tools.